[iSpotTV] How Insurers Used An “Off-Season Surge” on TV as their COVID Insurance Policy

In 2013, The Martin Agency ran a series of GEICO commercials called “Did You Know?,” where one person asks the other, “Did you know 15 minutes could save you 15% on car insurance” to which they reply, “Everyone knows that!” and then they cut away to an absurdist punchline. The ads are hilarious but they’re also incredibly effective since they do two things simultaneously: They work to reinforce the brand (top funnel marketing) but also they elicit a specific call-to-action (bottom funnel marketing). The technique is called “brand response” and it’s paved the way for an entire genre of memorable, irreverent, actionable copy-cats.

The rationale is driven by the idea that fickle consumers have been conditioned to the idea they can switch providers in 15 minutes. But they’ll only do it if they truly trust the brand. So insurers churn out lots of content and flood high-ratings TV shows such as tentpole sporting events (NBA playoffs) and network sitcoms (Friends).

Every year, auto and home insurers experience their own form of “off-season.” After wrapping a busy nine months of heavy investment in NFL and NBA ads — generally culminating in the Super Bowl in late winter and the NBA finals in early spring — companies like GEICO, Progressive and State Farm tend to put their feet up and ride out the generally slow summer TV season.

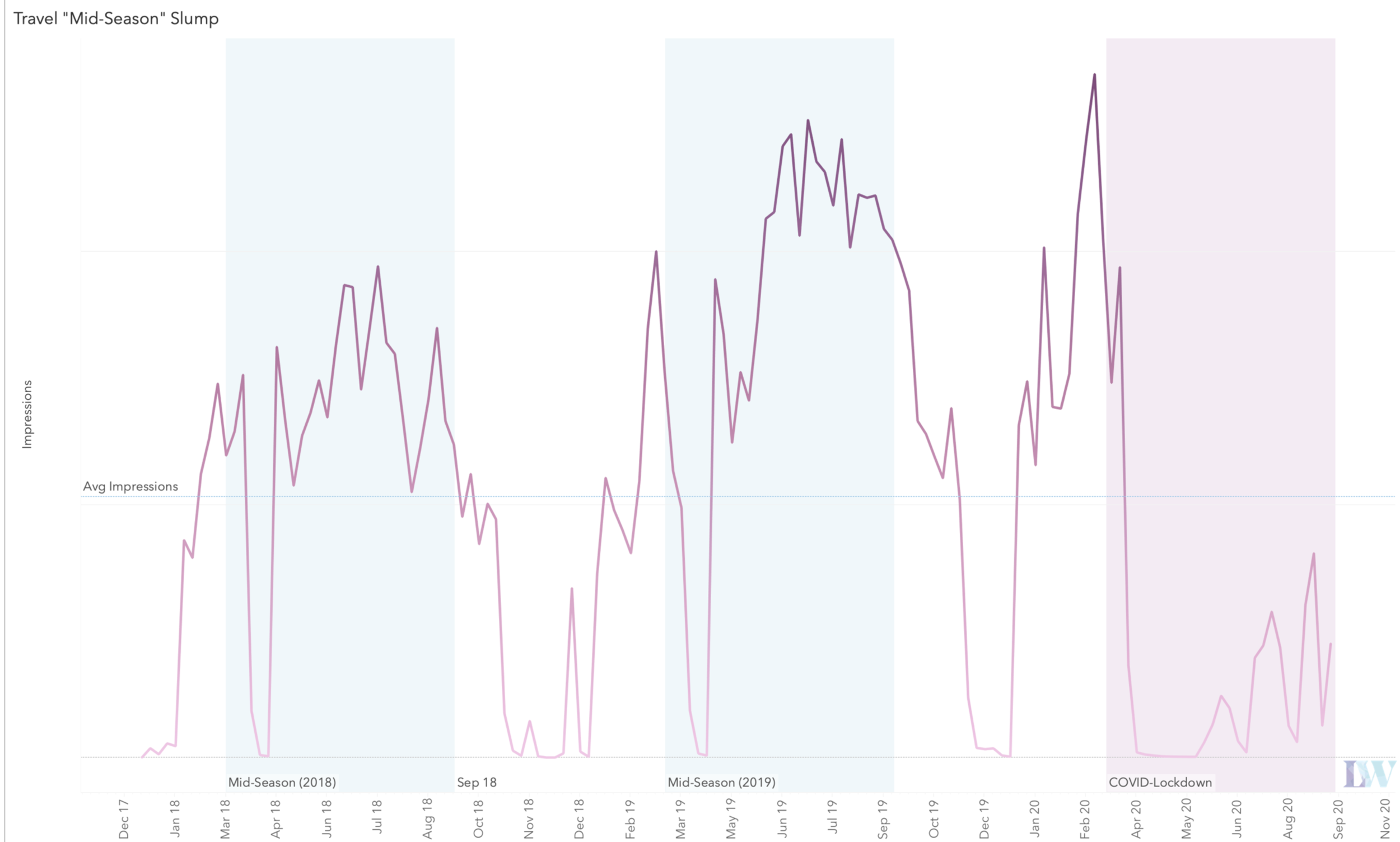

(Insurance saw an off-season surge during COVID-lockdown)

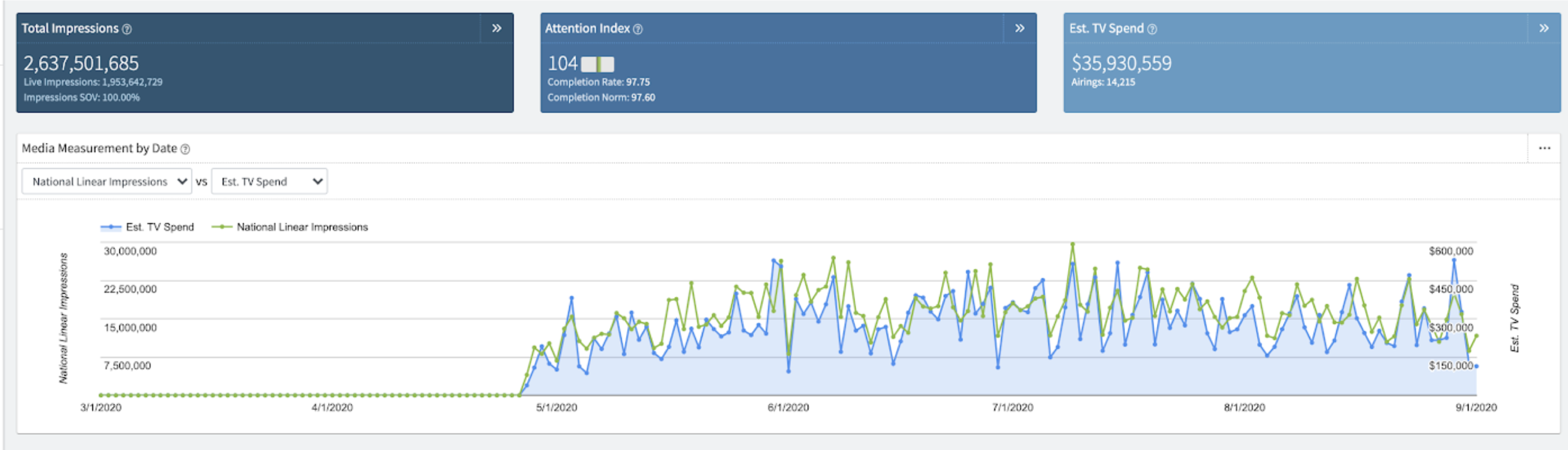

But after COVID hit the US in March 2020 — shuttering sports, live events and TV production — and stay-at-home orders forced 160 million Americans into their homes, auto and home insurers’ spend actually increased dramatically. All the while, other industries like travel and retail that tend to heat up during warmer weather, plummeted.

So what prompted this “off-season surge?” Was it consumers suddenly clamoring for new auto insurance with offices, schools and nightlife suddenly closed indefinitely? And how did insurers even find the TV inventory they needed without their usual tentpole events like the Olympics and NBA playoffs to buoy engagement? And most importantly: did it work? (Hint: it was an enormous success)

Consumers Stayed-At-Home & Insurers Saved

Insurers work off of something called the “combined ratio” to help determine, among other things, how much cash flow is available (and needed) for ad spend. A 2020 McKinsey study attempted to look at how the COVID recession might disrupt this ratio:

“First, claims frequency will initially go down. As physical distancing is widely encouraged, particularly in states with shelter-in-place directives, individuals have been driving much less.

Second, insurance companies will face top-line pressure. As new-car sales decrease, auto insurance will slow down. ”

Historically speaking, auto accidents tend to decline during recessions. During COVID, driving decreased between 50-80%. Insurance claims dropped, throwing insurers’ combined ratios off, freeing up cash flow.

But simultaneously, demand for insurance dropped off. Google Trends showed a big drop in car and home insurance volumes in March, while a study from LexisNexis’s Insurance Demand Meter showed that on March 16th “[insurance] shopping declined to -11% year-over-year growth, the lowest level in more than a decade.”

(Demand for car insurance briefly plummeted in March)

McKinsey noted that “in downturns, the ROI for retaining customers is often multiples of customer-acquisition spending, so customer retention becomes far more important.” In other words, preventing customers from churning is much more cost-effective than acquiring new ones. And with a big shift in their “combined ratios,” there was suddenly free cash flow available, and a race to retain customers took off, right when insurance advertising historically tends to drop.

Insurers Gave Back to Reduce Expensive Churn

To give an idea of scale, the difference between the nine month “off-season” from 2019 to 2020 was almost 35 billion impressions, per iSpot.

7 billion of those impressions were COVID-sepcific campaigns from GEICO (“Thank You,” “The Road Ahead”) with a markedly different shift in tone and aesthetic. “Thank You” featured all user-generated video clips with none of its traditional mascots. “The Road Ahead” featured an earnest and somber nod to the motorcycling community. Both ads evangelized a nationwide refund program called the “GEICO Giveback.”

(A single GEICO “Giveback” ad was responsible for over 2 billion impressions, per iSpot)

Ad Age reported that State Farm would be “returning up to $2 billion to its auto insurance customers as part of a recently revealed ‘Good Neighbor Relief Program.’ On average, customers will receive a credit of 25% of their premiums for the period between March 20 and May 31.” Liberty Mutual, Allstate and Progressive all followed suit.

The Off-Season Strategy Worked —Conversions Increased

And it turns out, the strategy worked

TransUnion looked at this same timeframe (March through May) and found that after the initial decrease in insurance shopping, demand rebounded by 12% in June. But more specifically, the strategy worked on TV. iSpot found that the entire home and auto insurance industry experienced a staggering 66% increase in conversion rates attributed to TV.

(Insurance companies saw an enormous increase in TV-attributed conversion rates)

They did this despite an evaporation of the types of impressions generally at their disposal. In 2019, nine of GEICO’s top 15 shows were sports programming. In 2020, it dropped to five out of 15. In total, they moved about 500 million impressions off of sports and added about 1.5 billion impressions onto non-sports programming.

(Insurers found impression inventory despite the disappearance of sports)

And, they made this change without shifting the underlying demographics by any noticeable amount.

(Insurers were even able to preserve their typical demographic mix per iSpot)

So right at the beginning of one of the sharpest recessions in 100 years, the major auto and home insurers were able to shuffle up their media plans, and identify where their audiences were scattering in the wake of the disappearance of sports and live programming. Investing heavily in TV spend on a set of traditional and COVID-focused creative, insurers were able to prevent churn and actually increase their TV-attributed conversion rates.

For the full study please contact info@ispot.tv.